FinTech sees itself as a disruptive solution to the old banking system and it’s certainly stealing ground from traditional banking services.

Goldman Sachs has estimated these start-ups could be taking up to $4.7 trillion in revenue from traditional banking sector each year.

FinTech start-ups are particularly successful at getting the attention of younger investors. Recent research into the Millennial generation, those born between 1980 and 2000, suggests that banks are utterly failing to communicate with these younger investors in the way they both want and expect. FinTech’s more nimble, customer experience-focused approach is winning over this group with far more success than traditional banking.

Disruptive nature of FinTech

Financial technology (‘FinTech’) companies are broadening access to a range of services designed to help us manage our spending, saving and investing. These innovative financial tools bring in new digital approaches to business, including peer-to-peer platforms (such as personal lending site Zopa), apps for tracking money and budget planning. The services FinTech now provides were once almost exclusively handled by banks.

The FinTech industry is booming, and enjoying regular cash injections from the venture capitalists and crowdfunders. All this represents a threat to traditional banking industry, which is responding by closing branches and raising banking fees as it reshapes its profitability model around the new market conditions.

Digital technology has delivered new product offerings that seem to be better meeting the needs of consumers.

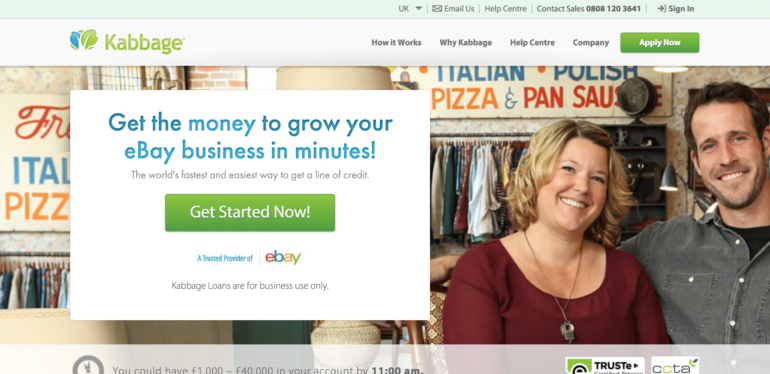

Consumer expectations for communication are also evolving – consumers increasingly expect real-time communication and are open to communicating with brands via social media. A quick comparison of the small business loans services offered by FinTech startup Kabbage and the well-established global bank HSBC demonstrates how fresh the FinTech communications approach looks in comparison. Even the colours are more vibrant on the Kabbage site, which uses spring green, than on the grey and black HSBC site

Kabbage

Head to the HSBC site and as soon as you click to apply for a loan, you need to either open an account or visit a branch. It’s just not as simple as on the Kabbage site, which has an online form and even gives you an idea of how quickly you may be able to get the loan. HSBC doesn’t give any sense of urgency about providing you with a loan. Kabbage seems very quick and simple in comparison to the rather stuffy and obstructive HSBC site.

Millennials turn away from banks

A recent report by Viacom identify the industries most likely to be transformed by Millennials – those born between 1981–2000.

The report, released in the middle of 2015, draws on three years of research and identifies that Millennials don’t feel as attached to banks as previous generations, possibly because of their experiences with the economic crunch. Of this generation’s ten least favoured brands, four are banks. Many don’t see their bank as being any different from any of its competitors.

73% of Millennials expressed more interest in obtaining financial services from a tech company than a bank, and a third of them don’t expect to need a bank at all by 2020.

Perhaps most tellingly, over 70% of them would rather go to the dentist than engage with their bank. Another study by Harris Interactive also finds that younger investors tend to be less trusting of financial institutions compared to older investors. It’s from this climate of hostility, indifference and mistrust that the FinTech industry has emerged.

The language of FinTech

Innovation lies at the heart of FinTech’s success. The services the sector provides seem to fit the lifestyle needs of consumers and the types of technology they are comfortable with, such as peer-to-peer services and downloadable apps. FinTech is also seems to be more successful at communicating using the customer’s own language. Communication is always a challenge in the financial services industry.

Traditional banking institutions tend to be naturally conservative and reluctant to rush to express an opinion about anything; this makes it difficult to communicate with a generation used to instant messaging and real time communication.

The distrust in financial institutions brought on by the 2008 financial crisis, and changing consumer expectations about how brands should communicate with them, are causing problems for traditional banks when it comes to speaking to their customers. In a world where customers are increasingly accustomed to brands speaking to them in a human voice through social media, the finance sector’s compliance concerns are making their communications seem increasingly stiff and remote.

FinTech companies also enjoy an agility that banks don’t have, and are less constrained about what they can say. Regulators just can’t move fast enough to keep up with this industry. But it’s unfair to say that FinTech can operate as it wants – in the absence of regulation, these start-ups need to work even harder to engender trust from their audience. Perhaps this is why they are winning customers over – they have to try harder.

These very young companies emerge with absolutely no credibility, offering entirely new financial products, so they have to work especially hard to win the trust of their customers.

Kabbage puts all its credentials front and centre of its communications. Next to the sign up form it lists social proof (“Trusted by over 100,000 businesses.”) and draws on the external authority of awards bodies and independent security badges to promote trust. There’s no such effort made by HSBC, which is perhaps relying on its name and reputation. Since the banking crisis of 2008, these mean very little. HSBC needs to re-establish trust and credibility if it’s to win back customers from brands like Kabbage that are trying harder to please them.

A personal approach

Boston Consulting Group believes the Millennials are actively seeking a more personal connection with the brands that they do business with, expecting to be listened to anywhere and anytime, and to have “personal, timely, and straightforward communication about their concerns and experiences.”

This suggests that financial services may benefit from better use of automated and personalised communications if they want to engage with and retain younger customers. Rather than obliging customers to login for financial statements, they might consider emailing pension portfolio forecast to their customers.

It’s also thought that this generation may have low financial literacy, so organisations will need to put more effort into educating their customer base and providing information in clear language and an easy-to-understand format.

It’s not clear whether financial services companies are able to put this effort in to giving younger investors the relationship with them that they want and expect. While traditional financial services institutions are hamstrung by fear and their own suffocating internal procedures, agile FinTech startups are reimagining what kind of products and services the industry should be providing, and how these are delivered. The triumph of FinTech has been to radically change the customer experience.